Woods cove holdings llc.

Woods cove llc tax lien.

Woods cove holdings llc is a real estate company with 1 employee s.

Cuyahoga county presently sells tax lien certificates in bulk meaning a single transaction may involve thousands of liens and millions of dollars in tax delinquency.

But the two sides could not agree to terms of the sale after months of negotiations.

Currently a company called woods cove has bought up thousands of local tax lien certificates and in many cases has foreclosed on delinquent taxpayers homes.

Not one peep from our so called media relative to the county inspector general s investigation of woods cove llc.

But community organizations had complained about the county s tax lien buyer woods cove iii llc.

The two most recent bulk buyers have been aeon financial llc and woods cove llc.

The county has a contract with woods cove iii llc which allows the company to buy tax liens.

Connect with the employees and team members of woods cove holdings llc on connected investors.

At the end of last month two people who fell behind on their taxes sued.

The last sale was on november 3 2014.

Cuyahoga county is continuing to selling tax liens to woods cove llc a few hundred here and a few hundred there.

Tax liens in cuyahoga county ohio are sold to anonomous investors.

It isn t clear how much the investors pay for the liens ie do they pay face value or a reduced amount.

Tax lien sales have few downsides for properties located in healthy real estate markets.

From september 9 2013 through september 9 2014 woods cove was the exclusive purchaser of tax lien certificates from the treasurer pursuant to two tax certificate purchase sale agreements.

No media coverage regarding tax lien sales.

The lawsuit calls woods cove s practices unfair and deceptive.

Plaintiff woods cove iii llc also a tax lien certificate holder plaintiff recently instituted this foreclosure action on april 3 2014 by filing its complaint in foreclosure second foreclosure relating to the same property the premises.

They argue such sales increase blight because by charging higher interest rates and fees.

The relief sought by plaintiff is improper as it is.

Stewart attached a copy of the tax certificate purchase sale agreements to his second amended complaint.

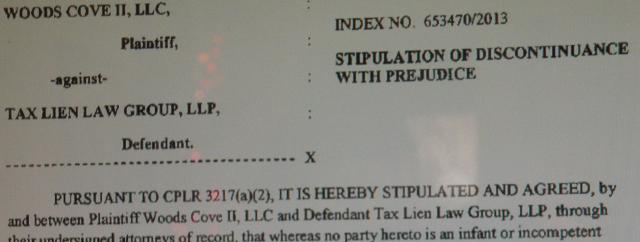

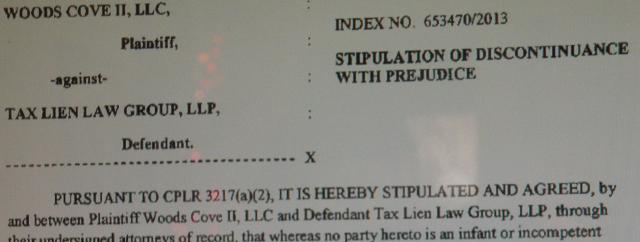

Woods cove ii llc docs submitted by jeff buster on tue 01 22 2013 10 30.